Evan Soltas has a very interesting blog post about intergenerational inequality. The thrust of his argument is that inequality in educational attainment exists, even adjusting for differences in income. At some level, this is trivial – one would expect educated parents, wealthy or not, to spend more on academic pursuits for their children. The conclusion Evan draws, however, is quite fantastic that is, the effect of educating a kid today is geometrically valuable:

Here’s why that math is important. The high school dropout rate among people whose fathers were dropouts is 22.2 percent. The dropout rate with high-school-grad fathers is 2.9 percent. Let’s assume that the social value of a high school degree is $30,000 per graduate; that’s roughly the difference in average income between non-grads and grads. Public policy that supposes they are helping one person assesses the value of that degree at $30,000, obviously. Public policy that supposes they are helping an infinite succession of people assesses the value of that degree at $819,000.

He arrives at a whopping $819,000 as the difference in the net present value of fathers with and without high-school degrees in terms of the future earning potential of their kids. I would argue that the value of a high-school degree is somewhat less than $30,000 because a good amount of the delta is derived from the further division between college graduates and non-graduates. This wouldn’t change the situation if the deviation was randomly distributed (and college actually added value, a contestable claim), but there’s good reason to believe it’s not. (For example, there are definitely demographics in which it’s very likely a child graduates high school, but also very unlikely that he or she graduates a 4-year college).

That even basic jobs require a college degree nowadays would further diminish the value of a high school degree by itself. The $819,000 figure includes the increased chance of attending college, which is far more dubious in its actual value added. A more conservative, but not necessarily better, approach would be to estimate the value added by high school itself, assuming that college adds no value, or approximately $11,000, according to Pearson.

The geometric multiplier is about 26.15, yielding a present value of $298,615. This isn’t nearly as astonishing as Evan’s $819,000, and probably isn’t as close to the truth. However, it does compound an already compelling case for investing in high school education; that it’s worth it even if no one ends up at college. At a public school, the average cost per pupil is $10,652 or about $40,000 for a degree, or a 645% return on investment. This is a low-hanging fruit.

I think there’s one big flaw in the way Evan looks at things; it’s also important to note that the value of a high school education is hugely understated by the calculated figure, because it is the difference in annual income. The effect over a lifetime is many multiples of this. For this reason, the return on a high school degree, a net of 645%, doesn’t begin to approximate the real value of an education.

A final caveat, I have a pretty strong feeling that education by itself doesn’t explain the intergenerational inequality in education. As it happens, I came across this passage in a recent copy of the Economist:

The well-to-do [have] largely held to old-fashioned ideas about marriage. Among professionals, births within marriage are four times as common as births where the father is registered as absent from the household.

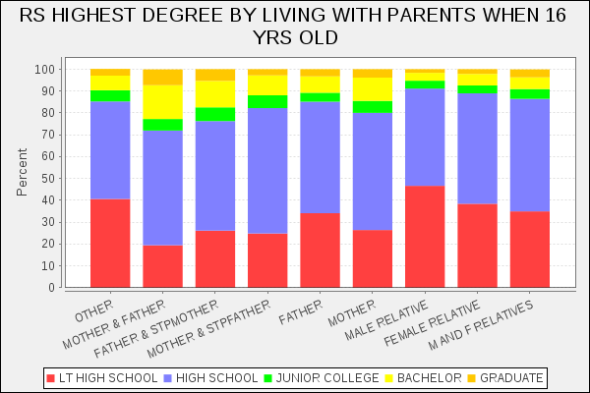

This is for Britain, but the gap is only worse in America. The figure below charts educational attainment of a child by family situation at age sixteen.

One can see an almost twofold increase in dropout rate between dual and single guardian households (the exception being families where neither of the guardian is directly related to the child). The geometric multiplier between a nuclear family and anything but is about 20. While this is less than that of a high school degree, the policy cost is also substantially less than $40,000.

Today, in many ways, we disincentivize marriage – as Nicholas Kristoff grimly notes – with poorly designed welfare programs (such as handouts to single mothers). As the Economist notes, I don’t believe the chain of causality is as strong between an educated parent inculcating similar values in his children as much as strong tendencies towards the nuclear family among the educated, which themselves engender stronger attitudes about education.

Regardless, any of these points are a damning indictment of the “American dream”. Policymakers need to acknowledge the importance of a high school education. We’ve spent billions in grants and subsidized student loans for college that implicitly benefit the lucky, that is those who already have a high-school education.

Further, it is far from established that college today adds economic value to society. The huge underemployment of recent graduates (which itself causes the unemployment of those without a college degree) should make each of us think twice while promoting the virtues of college.

Indeed, the advent of online courses further convinces me that college is but a licensing factory. For example, a University of Washington course in Financial Econometrics is provided on the Coursera platform, with the additional option of doing slightly more work and receiving slightly more attention, at a price tag of $4,000. This is absurd. The only value derived from the for-credit option is Washington’s official stamp of approval, a license.

By blindly subsidizing college education we’re implicitly encouraging rent-seeking behaviors that are damaging to society as a whole, especially those at the bottom. Evan’s point is clear: we need to stop acting like a high school degree is its present value, so long as inequality persists. Indeed, Evan hugely underestimates the value of his own claim by ignoring the lifetime effect of increased cash flow. For those of you interested in that figure, even discounting at 15%, it’s over $10 million.