The Libertarian Word for Inequality

Is “reset”. Ok, snark aside, I think Tyler Cowen is onto something here:

Fear the reset. The world will continue to produce much more value, and much more gdp, but who will capture that value is already changing dramatically and will continue to do so.

The life cycle consequence of a falling labor-share of GDP is something I’ve been meaning to write about especially after reading a paper from Mark Huggett and Greg Kaplan that’s quite relevant, titled “The Money Value of a Man”:

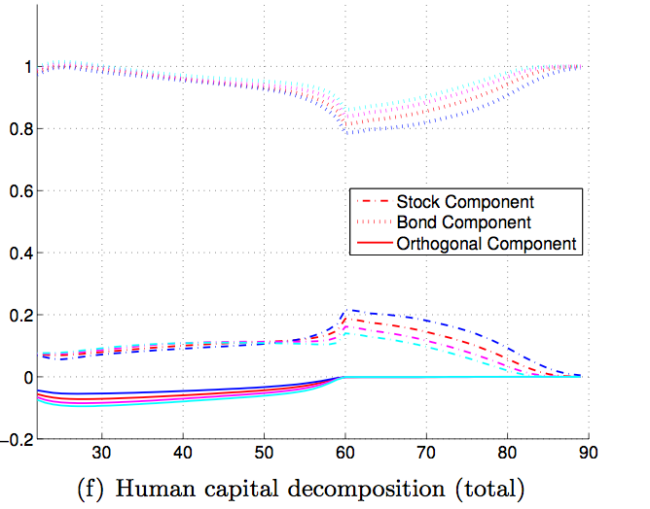

This paper posits a notion of the value of an individual’s human capital and the associated return on human capital. These concepts are examined using U.S. data on male earnings and financial asset returns. We find that (1) the value of human capital is far below the value implied by discounting earnings at the risk-free rate, (2) mean human capital returns exceed stock returns early in life and decline with age, (3) the stock component of the value of human capital is smaller than the bond component at all ages and (4) human capital returns and stock returns have a small positive correlation over the working lifetime.

Huggett and Kaplan rightly suggest that this is of significant importance in portfolio allocation. To the extent human capital is our most valuable asset, the best investment advice requires an understanding of the relative magnitudes of stock and bond positions thereof. As they posit, this brings an interesting new light to the international diversification puzzle suggested by Marianne Baxter and Urban Jermann (1997):

Despite the growing integration of international financial markets, investors do not diversify internationally to any significant extent. We show that this “international diversification puzzle” is deepened once we consider the implications of nontraded human capital for portfolio composition. While growth rates of labor and capital income are not highly correlated within countries, we find that the returns to human capital and physical capital are very highly correlated within four OECD countries. Hedging human capital risk therefore involves a substantial short position in domestic marketable assets. A diversified world portfolio will involve a negative position in domestic marketable assets.

Huggett and Kaplan note that this is “unsolvable”, for wont of a better term, to the extent we don’t understand the decomposition of human capital in similarity to domestic stock returns. But the “reset” Cowen is concerned with strictly concerns this gem from the paper:

The mean return to human capital falls with age over the working lifetime. Moreover, the mean return greatly exceeds the return to stock early in the lifetime. Both of these results are related to our findings on the value of the orthogonal component. We show that the mean human capital return always equals a weighted sum of the mean stock and bond returns. The weights are determined by the projection coefficients from the value decomposition. These weights sum to more than one exactly when the value of the orthogonal component is negative. Thus, human capital returns exceed a convex combination of stock and bonds returns. Human capital returns and stock returns have only a small positive correlation over the working lifetime. This correlation is higher for high school than for college-educated males.

The emphasized is of real importance considering the falling labor position of America’s uneducated youth to international and technological competition. (Indeed this might fall more acutely on the “middle-skilled” rather than blue-collar labor, but mechanics and technicians have always been better options than retail or sales). See below:

Contrary to what Cowen’s analogy with “tenured professors” and other insiders would suggest, the weight of the “bond share” in human capital decreases by age (until social security). The comparison is quite self-evident. Indeed, as a tenured professor himself, Cowen’s “human capital” is like a very valuable perpetuity. The risk is negligible, yields are (relatively but deservedly) lavish and predictable. Indeed for a tenured professor, the bond component is far higher than the above graph suggests. An important critique to the study is the rapid structural change the American economy has experienced over the past 40 years (note the entrance of robots and China). The comparison between t = 30 and t = 60 is not ceteris paribus.

The story with a high-class escort and street prostitute is the same. But unlike the unionized world of yore, job security is no sure thing, and the college premium might be increasing on the mean, but a surprising number of graduates will likely fall closer in bond component to earlier high school graduates than the mean college graduate. (Indeed the mean-median gap is likely to increase).

And one dynamic, noted in the Huggett-Kaplan paper, is also liable to change: “mean human capital returns exceed stock returns early in life and decline with age”. If labor share of income continues to fall at its current rate – though I doubt it will – the inequality implied by the above statement (note the work the word “mean” is doing) would be improbable.

The remedy here is something both far from ideal and practical: international capital endowments. (Note, I take the importance of improving education, not necessarily spending more money thereof, for poor youth as a self-evident necessity and as a given in any proposed solution).

Let’s call this a conditional capital transfer. Those who graduate high school will be given a lump-sum Vanguard Exchange Traded Fund, or something of that sort. Once you graduate college you’ll be given a little less. If you dropout, periodic such lump-sums can be granted by entry into vocational training programs and as an incentive to remain in the labor force. This can be a strong countervailing force to the increasing number of people living on disability benefits after cyclical downturns.

Liberals are often worried about job security and inequality thereof. Cowen is right, we need to spend more time understanding the mean-median spread in bond and stock returns to human capital as a life-cycle force rather than pure income itself. I am curious to see how a similar decomposition would fit Germany. I expect the secular change to be dampened relative to cyclical events.

Pingback: How much should we be fearing “resets”?

Pingback: Every Man a Dyna-byte | This is Ashok.

アウロラ 万年筆

パーカー parker